First of all you will ask why Gilgamesh? What or who is it? The Gilgamesh platform is named for The Epic of Gilgamesh, conclusively considered the first written story, which dates back to 2000 BC and is written in the Sumerian cuneiform language. This is the oldest written story known to exist and is loosely based on the historical King Gilgamesh who ruled Sumerian Uruk (today it’s Iraq) in 2700 BC. The oldest written version of the poem dates to circa 2000 BC. And cuneiform is one of the earliest forms of writing. In its written form the poem denotes the first marker in the evolution from oral storytelling to the tradition of the written word.

What it is?

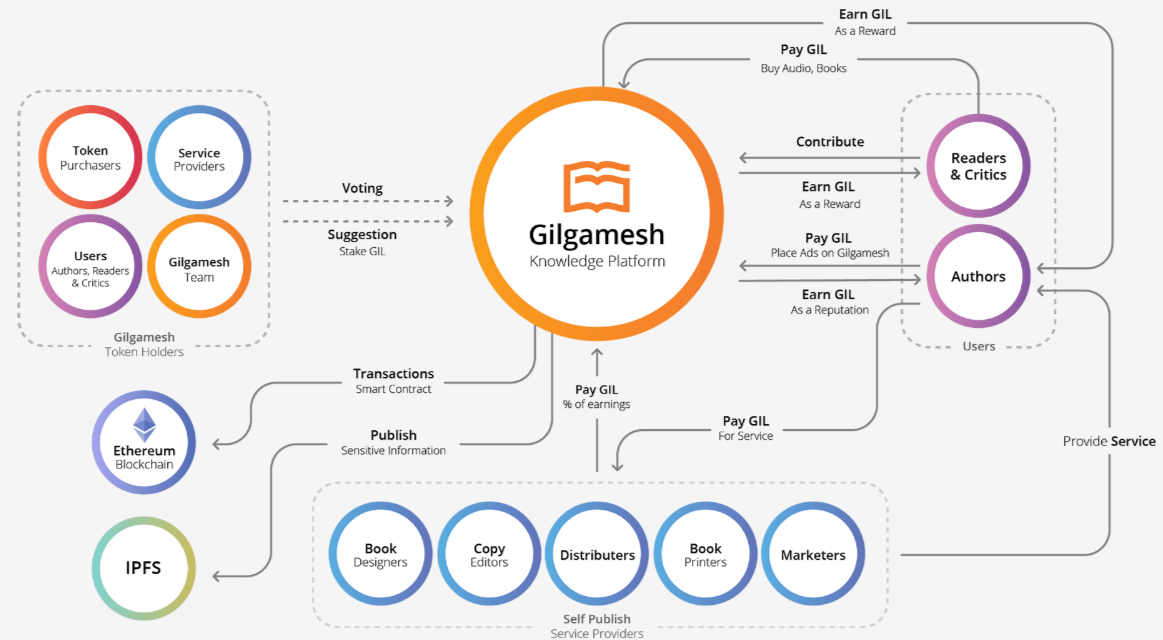

Gilgamesh is a self-governing, knowledge-sharing social network platform powered by Ethereum smart contracts, IPFS and blockchain technology to create a secure, fair, and engaging ecosystem that connects readers, critics, authors, and self-publishing service providers to influence the book industry and remove the role of publishers as the middleman between the flow of knowledge from authors to readers.

The Gilgamesh platform is a knowledge-sharing social network powered by the Ethereum blockchain and IPFS that socially connects readers, critics, authors, and service providers, and empowers all users to become more knowledgeable and information-centric through a cohesive and engaging user experience. The platform is a resource for knowledge-seekers to unite and create an organized and infallible outlet that transforms the publishing industry and the way readers interact with one another by using Blockchain technology. The platform is an accessible, fair market ecosystem that incentivizes readers, critics, authors, and service providers with “GIL” Tokens in proportion to their contribution through Ethereum smart contracts.

Phase one of the Gilgamesh platform will focus on organically growing user participation through interactive knowledge-sharing and incentives, and will meet a need in the market for a social platform that allows readers and participants in the book reading tradition, to share knowledge with one another in an interactive way.

Phase two of the Gilgamesh platform will establish a network that removes the middleman in the publishing industry to garner more financial support for authors and remove the barrier of access for people to transfer and receive information. The selfpublishing platform will replace traditional publishers, the “middleman”, by employing the marketplace power of Ethereum network, blockchain technology, and IPFS. By removing the middleman, society will experience an increase in the flow of knowledge between authors and consumers since more people (authors) will have affordable, unencumbered access to share knowledge, experience, and expertise with readers.

The Gilgamesh platform is named for The Epic of Gilgamesh, conclusively considered the first written story. The Epic of Gilgamesh dates back to 2000 BC, and is written in the Sumerian cuneiform language.

The problem :

Books have been our main source of knowledge for thousand of years. However, with the advent of new technologies and the internet, there is no simple, meaningful, and productive platform that encourages book readers and authors to connect, engage, and gain knowledge. Instead, the market is full of stagnant and outdated platforms that no longer satisfy the demands of the book community.

The Solution :

The Gilgamesh Platform removes the communication barriers established by eliminanting the publisher as a middleman. As a result, the platform gives readers, critics, and authors an opportunity to control the book market.

Authors can break free a monopolizing business partner (publisher) and gain full control of their.

I think it’s really great idea that creates true and fair interaction between Readers/Critics, Authors, and Service Providers. And Gilgamesh Platform is the world first platform which will do this on blockchain technology through Ethereum smart-contracts and also IPFS technology. IPFS is peer to peer hypermedia protocol and a cryptographic hash that will be used to store critical information such as book files and user information, IPFS is a great match for blockchain based software, we can store large amount of data with IPFS and insert immutable IPFS link into the blockchain transactions or smart contract, this can secure and timestamp our content without having to put the data on the blockchain.

Why blockchain and the token :

Readers could buy books for GIL tokens, which are internal currency of the platform and which they could earn by their activity or simply buy it through cryptocurrency exchanges where GILs are tradeable.The self-publishing platform will allow for the transfer of GIL between authors and self-publishing service providers and will act as a token earning source for the Gilgamesh platform. Self-publishing service providers include: book designers, copy editors, distributors, book printers, and marketers, who advertise their services on the platform to make valuable connections and earn GIL as income.

Ethereum smart contracts, IPFS, and blockchain technologies creates a transparent, censorship-free and secure ecosystem for the book market.

Ethereum smart contracts, IPFS, and blockchain technologies creates a transparent, censorship-free and secure ecosystem for the book market.Token sale

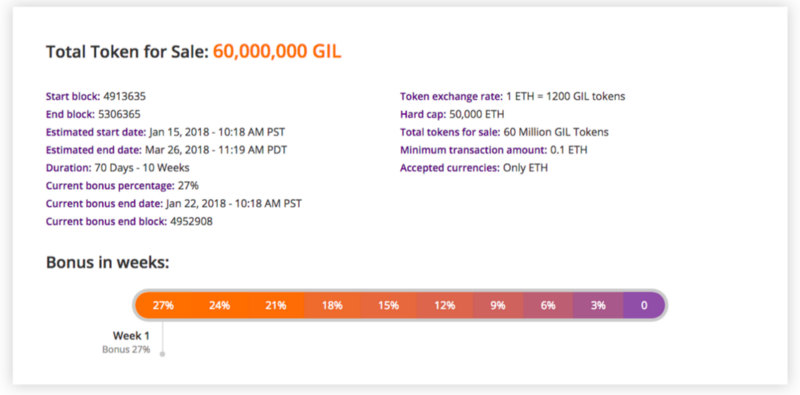

Gilgamesh Token Sale is already opened to the public from Jan 15th, 2018 4:00 PM (16:00) UTC and will run for 10 weeks until March 26th, 2018 4:00 PM (16:00) UTC

GIL Token Distribution

The GIL Token is a utility token meant to be used only on Gilgamesh Platform and it should not be used for investment, GIL Token is an incentive to boost user engagement, grow the platform organically, raise capital, and create a fair market economy. The GIL Token also represents Governance of the platform, and will give token-holders voting power over platform decisions.

Token Sale Purchasers: 25%

Skiral Inc. will utilize a token sale campaign to raise money for the development of Gilgamesh Platform. Token sale purchasers can gain influence in the governance of the Gilgamesh platform, spend tokens on the platform on goods and services, or maintain their initial status to vote and influence the Gilgamesh platform for future features and changes.

Founders: 20%

The Gilgamesh platform will be built by a core team of developers and programmers over the course of several years. To reward past work and stimulate progress, the founders and early contributors will be given GIL Tokens as a reward and to acquire governance power over the platform.

Founders will receive GIL tokens over a 24-months vesting period with a 6-month cliff which means founders will mature 25% of their GIL tokens every 6 months.

Early contributors & Advisors: 5%

Early contributors will receive GIL tokens over a 6-month vesting period with a 3-month cliff, which means early contributors mature 50% of GIL tokens at the end of the third month and the remaining 50% at the end of the sixth month.

Advisors will receive GIL tokens over a 1-year vesting period with a 6-month cliff which means advisors will mature 50% of their GIL tokens every 6 months.

Retained by Gilgamesh: 20%

The GIL Tokens will initially be locked and withheld for 18 months after the token sale from the platform and disbursed slowly for future growth and to sustain the GIL ecosystem through platform operations, research and development, and product discovery and expansion.

Users in the Gilgamesh Platform: 30%

GIL tokens will be retained for distribution to users based on productive contributions to the platform. however, every year 5% of tokens will be injected to the platform for 6 years, afterwards it's expected that Gilgamesh Platform earns enough tokens to pay GIL tokens for platform users. The tokens can be used to buy goods or services such as books or publishing services on the platform or can be held by users for voting power to govern the platform.

Token Distribution Details :

- Total tokens for sale: 60,000,000 GIL Tokens

- Start block: will be announced a day before the token sale

- End block: will be announced a day before the token sale

- Estimated start date: Jan 15th, 2018 4:00 PM (16:00) UTC

- Estimated end date: March 26th, 2018 4:00 PM (16:00) UTC

- Duration: 70 Days — 10 Weeks

- Token exchange rate: will be announced a day before the token sale

- Hard cap: Approximate $60M

- Total tokens for sale: 60 Million GIL Tokens

- Minimum transaction amount: 0.1 ETH

- Accepted currencies: Only ETH

- Github Link: https://github.com/skiral/gilgamesh-token-contract

- Token Type: ERC20 Standard14. Soft Cap: To be Announced

Participants who purchase GIL tokens in the first weeks receive additional 27% bonus tokens Bonuses :

Week 1: 27% additional

Week 2: 24% additional

Week 3: 21% additional

Week 4: 18% additional

Week 5: 15% additional

Week 6: 12% additional

Week 7: 9% additional

Week 8: 6% additional

Week 9: 3% additional

The Gilgamesh Platform Roadmap

More Information see on link below :

Website: https://www.gilgameshplatform.com/

Whitepaper: https://blog.gilgameshplatform.com/gilgamesh-white-paper-9998a1133ac0

Twitter: https://twitter.com/GilPlatform

Facebook: https://www.facebook.com/gilgameshplatform/

Github: https://github.com/skiral

Telegram: https://t.me/GilgameshPlatform

Whitepaper: https://blog.gilgameshplatform.com/gilgamesh-white-paper-9998a1133ac0

Twitter: https://twitter.com/GilPlatform

Facebook: https://www.facebook.com/gilgameshplatform/

Github: https://github.com/skiral

Telegram: https://t.me/GilgameshPlatform

Authors/Written by Profile : https://bitcointalk.org/index.php?action=profile;u=1770423;sa=summary

ETH address : 0x6dAAda7710bA09c916bd4f40a7eB3ABef2F45dcc

ETH address : 0x6dAAda7710bA09c916bd4f40a7eB3ABef2F45dcc