Forty Seven Bank is innovative financial technology start-up

aiming to provide high quality, secure and user-friendly banking

services for individual and institutional consumers, which will be

fully recognised by the financial authorities and compliant with

regulatory framework.

The bank is going to be specialising in digital finance services by

fully supporting cryptocurrencies and traditional fiat currencies.

Basic cryptocurrency procedures include sale and purchase features, investment and exchange options and crypto-saving and

current accounts.

fully supporting cryptocurrencies and traditional fiat currencies.

Basic cryptocurrency procedures include sale and purchase features, investment and exchange options and crypto-saving and

current accounts.

Multi-Asset Account will be one of the featured innovative products oered by Forty Seven Bank it will allow customers to have access to all their accounts in dierent banks and crypto wallets as well as to their investments and savings in

cryptocurrency and fiat equivalents via single application. It will be possible to operate with each asset type accordingly by having only one Multi-Asset Account at Forty Seven Bank.

We will oer unique crypto products like bonds, futures and options. Our goal is to invent such market place and take the leading position in both short and long-term perspectives. Companies will be able to attract finances via product invented by Forty Seven Bank — Cryptobonds. Cryptobonds will be traded on

various exchange platforms (mainly at the one developed by Forty Seven Bank).

What is Forty Seven ?

Forty Seven is a unique project built to create a modern universal bank both for users of cryptocurrencies and adherents of the traditional monetary system; a bank that will be acknowledged by international financial organisations; a bank that will correspond to all the requirements of regulators.

A team of professionals from the worlds of banking, finance, and IT with expertise and experience in the creation and licensing of payment systems, and building of electronic financial institutions will work to realise the goals of the project.

Our bank will become the biggest structure that corresponds to all the requirements of regulators and the EU Payment Services Directive 2 (PSD2). We will comply with Know Your Customer (KYC) and Anti-Money Laundering (AML) policies in order to guard against agents of the “grey” market.

Forty Seven is based on three principles: relevance, convenience, and security. Our specialists use up-to-date technological developments such as blockchain, biometrics, smart contracts, machine learning and many others. If you are interested in the specific details of our establishment and creation of a hi-tech bank, please see the following documents.

Mission of Forty Seven Bank

The mission of Forty Seven Bank and management team is to provide safe, innovative and user-friendly financial services and products to our customers individuals, businesses, developers, traders, financial and governmental institutions.

Forty Seven Bank is a bridge capable of connecting two financial worlds and establishing efficient communication between them, a communication that will open up possibilities to level up the whole modern financial system.

Our values are:

1.Transparency;

2.Financial stability;

3.Effectiveness and user firendly procedures;

4.Security and privacy (data protection);

5.Innovativeness;

6.Customer satisfaction;

7.Market share growth and worldwide expansion;

8.Profit for all stakeholders.

Innovative products for everyone

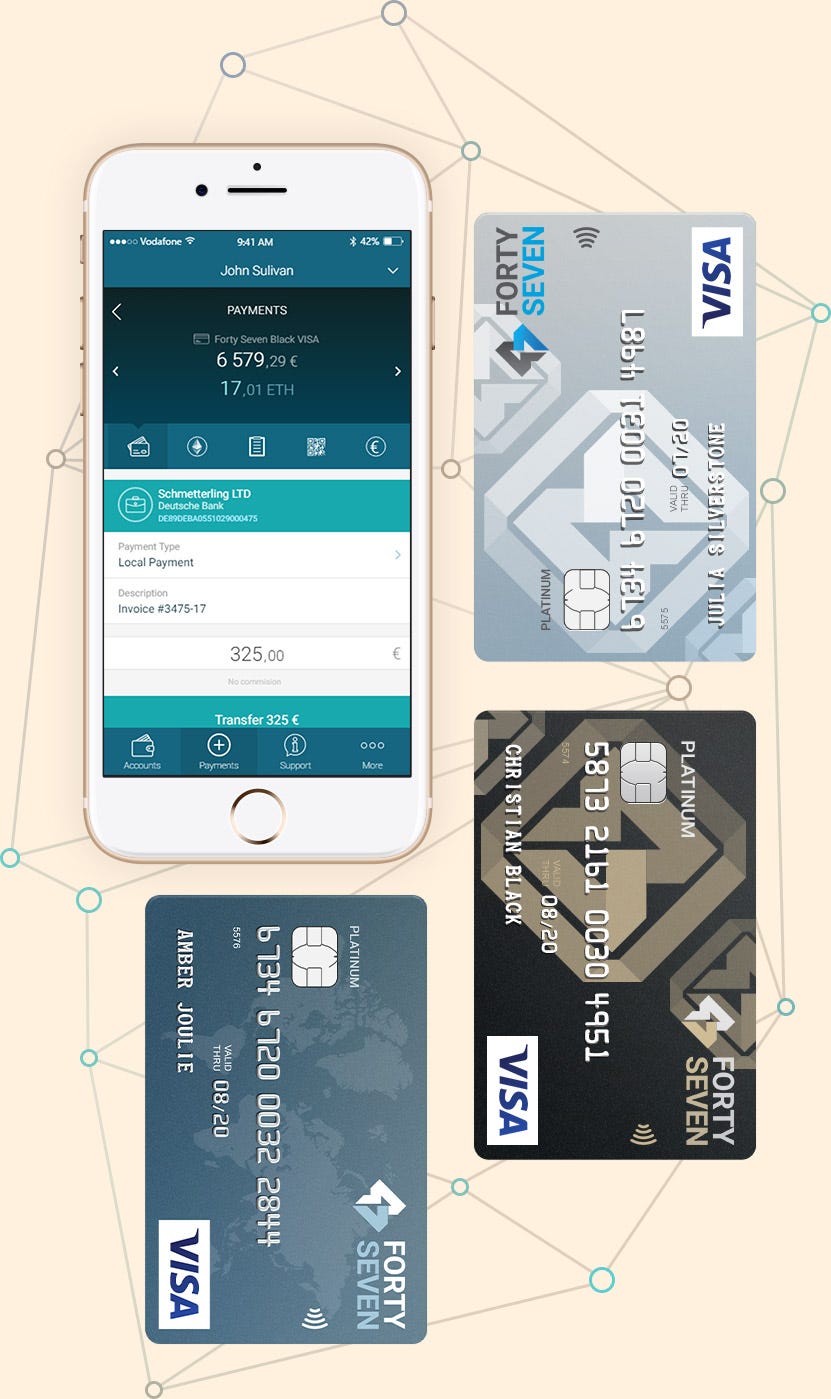

The featured product is a Multi-Asset Account for private customers with a tied card.

- Remote identification and authorisation based on passport and biometric data

- Unique combination of payment tools — SWIFT, credit and debit cards, e-wallets, secured cryptocurrency payments

- Transactions with any type of cryptocurrency through the bank’s application and with no need to wait for current exchanges. Uploading, withdrawal, and conversion by any pair is available

- Wide range of services including crediting, insuring, invoice presentation, credit/debit card management etc.

- Cross-platform access for clients to manage accounts opened with any European bank that complies with the PSD2 directive

- Convenient and user-friendly UI

- Analysis that helps a client to make the right financial decisions via services of a personal manager created on the basis of machine learning algorithms.

Multi-currency account. With the help of Forty Seven Bank, people living in European countries can easily open multi-currency accounts with their respective cards tied to it. With the help of this, you can easily manage accounts in European banks using convenient interface of an Internet bank or mobile application. Forty Seven Bank customers will be able to receive and send payments, convert currencies, buy and sell cryptocurrencies. Clients may pay with a card in any service centre, withdraw or transfer funds via ATMs.

- An integrated mobile and web-interface to manage accounts opened in any European bank in compliance with the PSD2 directive. On January 13, 2018, PSD2 directive on payment services will enter into force. Its regulations open up new possibilities for the clients. Clients will have access to centralised management of any account opened in person’s name in various EU banks. This solves the problem of bank transfers as well as removes the customer’s need to frequently login into several different financial structures to manage accounts. To use full list of Forty Seven Bank’s services, one needs to enter his European bank account number in the application or on the website and confirm authorised access to it.

- Remote identification and authorisation using passport and biometric data. To become a client of Forty Seven, one needs to visit bank’s website or download our application from AppStore. Identification is done online without the need to visit a local bank branch. After a quick procedure, a fully functional account is opened on client’s name and he immediately gets access to modern cryptocurrency services. Client’s payment card is then sent by mail to the address stated in the registration form.

- Analytics that helps clients to make right financial decisions by using services of personal manager developed on the basis of machine learning. FortySeven applications with the convenient and easy-to-use interface are ideal for funds management. Based on automatic analysis of monthly expenditures, they can manage personal and family budget guided by hints and advices obtained from a personal assistant.

- Cryptocurrency transactions within bank’s application. By using mobile applications, clients will be able to buy and sell any type of digital currency at bank’s internal exchange with low fees and a very negligible waiting time. Conversion in any combination, including ‘cryptocurrency — fiat money’ pair is available. Funds may be transferred to any of the connected accounts or a payment card.

- Unique and convenient combination of payment tools. Having a multi-account, clients of Forty Seven Bank will be able to use SWIFT system, credit and debit cards, e-wallets, make secured payments with cryptocurrencies. Clients get access to modern integrated bank service that comprises hi-tech mobile and online-banking, cryptocurrency applications and convenient tool for routine payments, available 24/7 in any part of the world.

Propositions for business

Business products oriented towards small and medium-sized enterprises.

- Managing an account via Application Programming Interface (API), creation of financial applications

- Receiving payments from a merchant in both cryptocurrencies and in fiat money on the company’s account (card, SWIFT) using a form or API

- Mass payouts for marketplaces

- Loyalty management for clients using big data

- Factoring services based on the operation of machine learning and big data (artificially intelligent algorithms able to predict the probability of repayment of credit as well as timeliness of repayment from a company)

- Escrow services

- Mobile application with biometric identification for multi-currency transactions.

Our products are aimed at targeting small and medium-sized enterprises. These products will allow quick integration of cryptocurrency payments for both online and offline use.

1. Selection of mechanisms to accept merchant’s payment. Our clients will be able to start accepting money on cryptocurrency accounts, cards, or SWIFT. By using our API, company owners will also be able to transfer them to their company’s account. Ability to accept cryptocurrency payments from buyers in online-stores, on websites, or via mobile applications may be set up using our CMS plugin, SDK or API. The funds transferred will be automatically converted at bank’s internal exchange rate and accredited to organisation’s account in corresponding fiat currency.

2. Ability to create applications that can manage clients’ accounts and are distributed through Forty Seven Bank’s app store. Representatives of large businesses can develop their own financial tools based on solutions offered by Forty Seven Bank. In compliance with the PSD2 directive, open API provides access to personal mechanisms of account management including making of automatic payments and mass payouts to partners.

3. Clients’ loyalty management using machine learning. Comprehensive analysis of big data allows predicting clients’ wishes based on their behavioural patterns. Creation and implementation of flexible loyalty programs are done on the verge of rational benefit parameters and implication of clients’ emotional impulses.

4. Factoring services based on machine learning. Regular collection and analysis of data will allow providing prompt factoring for our clients. Complex AI algorithms will be able to predict the probability of paying out credit taken by a company manager or the need for an organization to receive financial aid.

5. Escrow-service. Forty Seven Bank provides escrow services by being an intermediate between a buyer and online-platform. We guarantee square deals.

Tools and services for external developers

- Opportunity to provide Forty Seven banking services under your own brand (white label)

-API access that allows the development and implementation of modern financial services based on Forty Seven infrastructure and processes

-Holding DevDays conferences for independent developers

-A showcase of financial applications using Forty Seven API.

Forty Seven Bank opens a wide spectrum of possibilities for software developers and partner banks.

Access to API. Open API allows external developer to create modern financial services based on Forty Seven Bank’s infrastructure and internal processes. These applications can both expand the functionality of bank’s products and adjust to needs of other company. Use cases of such applications are limited exclusively to programmers’ vision and preferences of potential clients.

Forty Seven Bank will hold DevDays technological conferences for independent developers and financial institutions. We will invite both experienced developers and new enthusiasts who are interested in use of our bank’s API and creation of new products. We also plan to implement educational programs and courses with priority access For Forty Seven Bank token holders.

We offer the possibility to provide complete set of Forty Seven Bank services under personal brand (white label). With the help of this service, any banking organisation will be able to use our applications and services without the need to modify their existing infrastructure and the need to obtain additional licenses from regulatory organs. All that is going to be done while keeping your own clients and offering them dedicated Forty Seven Bank’s services under personal brand.

Access to bank’s app store as a distribution channel. Forty Seven Bank creates a universal financial app-platform that connects bank’s clients with developers and serves as a user acquisition platform for the latter. We aim to turn this app store into a powerful ecosystem that will grow and develop according to the needs of the market and bank’s customers. This platform will operate on a revenue share basis, meaning that developing popular applications for Forty Seven Bank’s app store might serve as a serious source of income for independent developers.

Features and technologies

Based on the possibilities of the banking and cryptocurrency industries, we will take the best of the two spheres using innovative and proven technologies in the fields of finance, analytics, and data security.

Forty Seven Bank will provide open, flexible and well-documented API covering the majority of banking services. We will launch our own financial application platform that uses our API. By attracting clients and external developers, we plan to turn it into an efficient ecosystem with constantly growing value.

Application of smart contracts to automate financial processes, thereby enabling us to make deals and give credits with no risk of fraud. The implementation of machine learning technology will allow the creation of a personal manager to foresee all wishes of the client. A virtual interlocutor will assist in the reallocation of cash flows and will provide timely current financial information.

Biometric technologies and blockchain will enable users to open an account distantly and access it via smartphone and ATM without using a card. In combination with cryptographic encryption, these developments will provide increased security of personal and payment data.

Roadmap

Our partners

ICO details

Emission of tokens

What is a Forty Seven Token: It’s a token that represents a part in Forty Seven Bank’s infrastructure and grants the wielder a priority place in the bank’s loyalty program. Holders of FSBT tokens have the right to receive yearly bonuses in the form of FSBL — Forty Seven Bank loyalty tokens. Besides that, FSBT tokens are a crucial economic part of Forty Seven Bank’s ecosystem — they will be needed in order to access the full range of products and services. After the crowdfunding campaign is finished, FSBT tokens will be available for trade at various cryptocurrency exchanges.

What is a Forty Seven Token: It’s a token that represents a part in Forty Seven Bank’s infrastructure and grants the wielder a priority place in the bank’s loyalty program. Holders of FSBT tokens have the right to receive yearly bonuses in the form of FSBL — Forty Seven Bank loyalty tokens. Besides that, FSBT tokens are a crucial economic part of Forty Seven Bank’s ecosystem — they will be needed in order to access the full range of products and services. After the crowdfunding campaign is finished, FSBT tokens will be available for trade at various cryptocurrency exchanges.

What is a token used for: 20% of the bank’s annual net profit will be invested into the loyalty program. Using smart contracts, each FSBT token holder will be able to receive their FSBL tokens based on the amount owned and afterward, exchange the FSBT tokens for different goods offered by the loyalty program (electronics, household items, airplane tickets, banking services, insurances, etc.). All FSBT token holders will receive the right to participate in Forty Seven Bank’s yearly crypto community development program and decide which projects will be supported by the bank and its shareholders.

Abbreviation: FSBT.

Control over emission: is provided by the system of interconnected smart contracts.

Rate: Fixed, value of one token — 0.0047 ETH.

Maximum amount of tokens to be generated: 11 063 829 FSBT (incl. bonus tokens, tokens for bounty and founders).

Minimum budget to start the project: 3 600 ETH (1M EUR).

Hardcap: 36 000 ETH (10M EUR).

Accepted cryptocurrencies on ICO: ETH, BTC.

ICO round 1: November 16 — December 16, 2017.

ICO round 2: December 17 — February 28, 2018.

ICO round 3: March 1 — March 31, 2018.

Token distribution

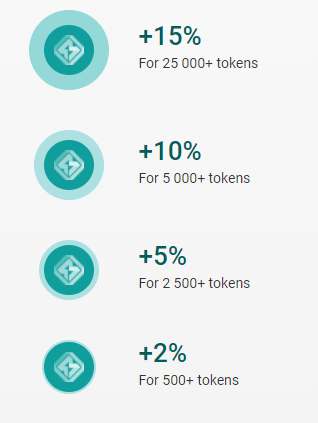

Bonus tokens for the contributors

1. During ICO round 1

2. During ICO round 2

3. During ICO round 3

Bounties

Calculated from the bounty pool (5%)

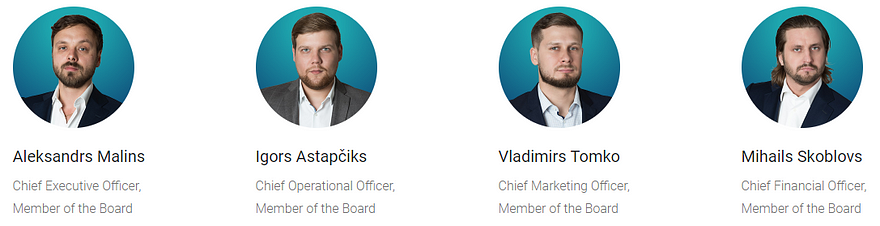

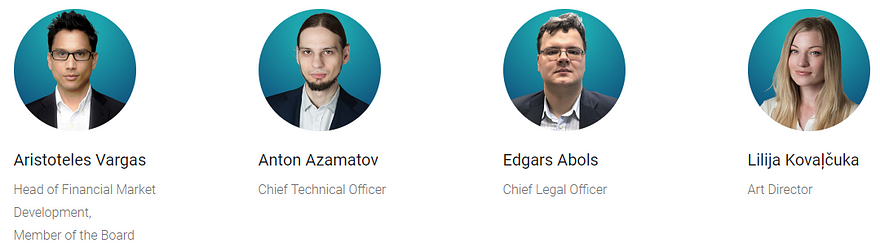

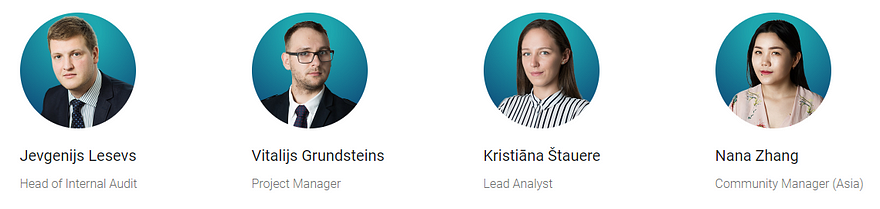

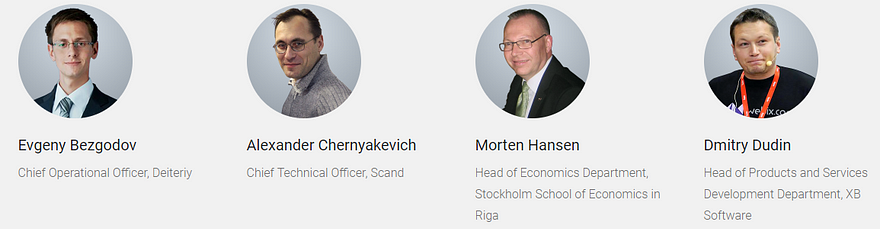

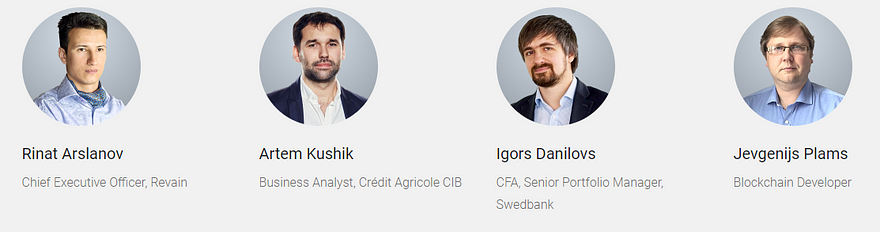

Executive team

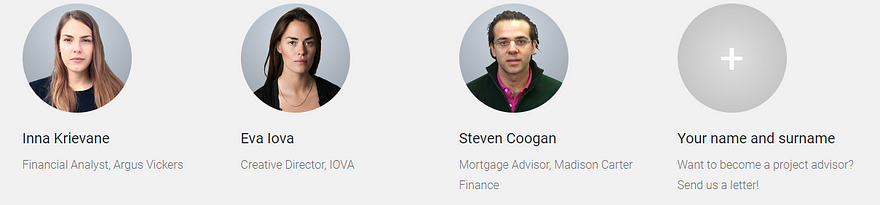

Advisory board

Details Information :

Website : https://www.fortyseven.io/

Whitepapper : https://drive.google.com/file/d/0BzvESRkgX-uDeHc1QjRzbHRBelU/view

Telegram : https://t.me/thefortyseven

Twitter : https://twitter.com/47foundation

Facebook : https://web.facebook.com/FortySevenBank/?_rdc=1&_rdr

Whitepapper : https://drive.google.com/file/d/0BzvESRkgX-uDeHc1QjRzbHRBelU/view

Telegram : https://t.me/thefortyseven

Twitter : https://twitter.com/47foundation

Facebook : https://web.facebook.com/FortySevenBank/?_rdc=1&_rdr

Profile : https://bitcointalk.org/index.php?action=profile;u=1770423;sa=summary

ETH : 0x6dAAda7710bA09c916bd4f40a7eB3ABef2F45dcc

ETH : 0x6dAAda7710bA09c916bd4f40a7eB3ABef2F45dcc

Tidak ada komentar:

Posting Komentar